UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]x |

Filed by a Party other than the Registrant [ ] ¨ |

| |

| Check the appropriate box: |

| |

[ ] | ¨ | Preliminary Proxy Statement |

[ ] | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

[X] | x | Definitive Proxy Statement |

[ ] | ¨ | Definitive Additional Materials |

[ ] | ¨ | Soliciting Material Pursuant to §240.14a-12 |

| | Consolidated Communications Holdings, Inc. | |

| | (Name of Registrant as Specified In Its Charter) | |

| | | |

| | | |

| | (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |

| Payment of Filing Fee (Check the appropriate box): |

[X] | x | No fee required. |

[ ] | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | 5) | | Total fee paid: |

| | | | |

[ ] | ¨ | Fee paid previously with preliminary materials. |

| ¨ | | |

[ ] | | Check box if any part of the fee is offset as providedFee computed on table in exhibit required by Item 25(b) per Exchange Act Rule 0-11(a)(2)Rules 14a6(i)(1) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | |

| | 1) | | Amount Previously Paid: |

| | | | |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | 3) | | Filing Party: |

| | | | |

| | 4) | | Date Filed: |

| | | | 0-11 |

CONSOLIDATED COMMUNICATIONS HOLDINGS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 27, 2020MAY 2, 2022

To Our Stockholders:

The 20202022 annual meeting of stockholders of Consolidated Communications Holdings, Inc. (the “Company”) will be held at Consolidated Communications’ corporate headquarters, 121 South 17th Street, Mattoon, Illinois 61938in a virtual meeting format only on April 27, 2020,May 2, 2022 at 9:00 a.m., central time. The 20202022 annual meeting of stockholders is being held virtually in light of continued public health concerns regarding the COVID-19 pandemic and for the following purposes:

1. To elect Robert J. Currey, C. Robert Udell, Jr., and Maribeth S. Rahe, as Class III directors to serve for a term of three years, in accordance with our amended and restated certificate of incorporation and amended and restated bylaws (Proposal No. 1);

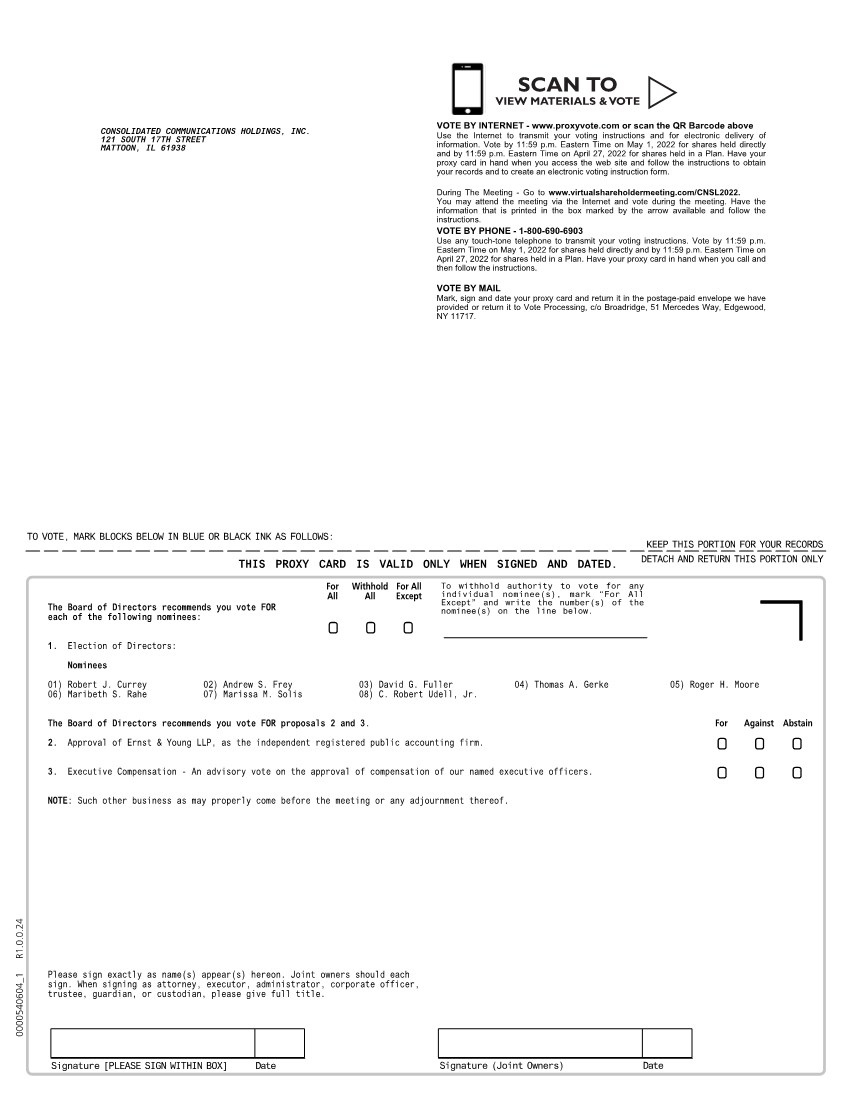

| 1. | To elect the eight directors named in our Proxy Statement to serve until the next annual meeting of stockholders or until their respective successors are elected and qualified (Proposal No. 1); |

2. To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020 (Proposal No. 2);

| 2. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal No. 2); |

3. To conduct an advisory vote on the approval of the compensation of our named executive officers (Proposal No. 3); and

| 3. | To conduct an advisory vote on the approval of the compensation of our named executive officers (Proposal No. 3); and |

4. To transact such other business as may properly come before the annual meeting and any adjournment or postponement thereof.

| 4. | To transact such other business as may properly come before the annual meeting and any adjournment or postponement thereof. |

Only stockholders of record at the close of business on February 27, 2020March 3, 2022 are entitled to vote at the meeting or at any postponement or adjournment thereof.

Your vote is very important. We hope that as many stockholders as possibleyou will personally attend the meeting. Whethervirtual meeting, but whether or not you plan to attend, the meeting, please vote your shares promptlyin advance so that your shares will be represented. If you received a printed copy of the proxy materials by mail, you may vote your shares by proxy using one of the following methods: (i) vote via the Internet; (ii) vote by telephone; or (iii) complete, sign, date and return your proxy card in the postage-paid envelope provided.We encourage you to vote via the Internet, as this is the most cost-effective method to cast your vote. If you received only a Notice of Internet Availability of Proxy Materials by mail, you may vote your shares at the Internet site address listed on your notice. If you hold your shares through an account with a bank, broker or similar organization, please follow the instructions you receive from the holder of record to vote your shares.

| By Order of the Board of Directors, |

| By Order of the Board of Directors,

J. Garrett Van Osdell

Chief Legal Officer & Secretary

|

| J. Garrett Van Osdell |

| Chief Legal Officer & Secretary |

March 18, 202022, 2022

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on April 27, 2020May 2, 2022 — Our Proxy Statement and 20192021 Annual Report to Stockholders are availableAvailable at www.proxyvote.com. Stockholders of Record as of the Record Date will be able to Attend the Stockholder Meeting Online by Visiting www.virtualshareholdermeeting.com/CNSL2022.

Table of Contents

Page

TABLE OF CONTENTS

CONSOLIDATED COMMUNICATIONS HOLDINGS, INC.

121

2116 South 17thStreet,

Mattoon, Illinois 61938

PROXY STATEMENT

This proxy statement contains information related to the 20202022 annual meeting of stockholders of Consolidated Communications Holdings, Inc., a Delaware corporation (the “Company,” “Consolidated,” “we,” “our” or “us”), that will be held at our corporate headquarters, 121 South 17th Street, Mattoon, Illinois 61938,in a virtual meeting format only, on April 27, 2020,May 2, 2022 at 9:00 a.m., central time, and at any postponements or adjournments thereof. The approximate first date this proxy statement and proxy card, as well as a copy of our combined 20192021 Annual Report to Stockholders and Annual Report on Form 10-K for the year ended December 31, 2019,2021, are being made available is March 18, 2020.22, 2022.

ABOUT THE MEETING

What is the purpose of this proxy statement?

The purpose of this proxy statement is to provide information regarding matters to be voted on at the 20202022 annual meeting of our stockholders. Additionally, it contains certain information that the Securities and Exchange Commission (the “SEC”) requires us to provide annually to stockholders. The proxy statement is also the document used by our board to solicit proxies to be used at the 20202022 annual meeting. Proxies are solicited by our board to give all stockholders of record an opportunity to vote on the matters to be presented at the annual meeting, even if the stockholders cannot attend the meeting. The board has designated J. Garrett Van Osdell and Steven L. Childers as proxies (the “Proxy Holders”), who will vote the shares represented by proxies at the annual meeting in the manner indicated by the proxies.

Why did I receive a one-page notice regarding internet availability of proxy materials instead of a full set of proxy materials?

The SEC rules allow companies to choose the method for delivery of proxy materials to stockholders. For most stockholders, the Company has elected to mail a notice regarding the availability of proxy materials on the Internet (the “Notice of Internet Availability of Proxy Materials” or the “Notice”), rather than sending a full set of these materials in the mail. The Notice of Internet Availability of Proxy Materials, or a full set of the proxy materials (including thethis Proxy Statement and form of proxy), as applicable, was sent to stockholders beginning March 18, 2020,22, 2022, and the proxy materials were posted on the investor relations portion of the company’sCompany’s website, http://ir.consolidated.com, and on the website referenced in the Notice on the same day. Utilizing this method of proxy delivery expedites receipt of proxy materials by the Company’s stockholders and lowers the cost of the Annual Meeting.annual meeting. If you would like to receive a paper or e-mail copy of the proxy materials, you should follow the instructions in the Notice for requesting a copy.

What proposals will be voted on at the annual meeting?

Stockholders will vote on the following proposals at the annual meeting:

| · | the election of Robert J. Currey, C. Robert Udell, Jr., and Maribeth S. Rahe as Class III directors to serve for a term of three years, in accordance with our amended and restated certificate of incorporation and amended and restated bylaws (Proposal No. 1); |

To elect the eight directors named in this Proxy Statement to serve until the next annual meeting of stockholders or until their respective successors are elected and qualified (Proposal No. 1);

To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal No. 2);

To conduct an advisory vote on the approval of the compensation of our named executive officers (Proposal No. 3); and

To transact such other business as may properly come before the annual meeting and any adjournment or postponement thereof.

| · | the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm (the “independent auditors”), for the fiscal year ending December 31, 2020 (Proposal No. 2); |

| · | an advisory vote on the approval of the compensation of our named executive officers (Proposal No. 3); and |

| · | any other business properly coming before the annual meeting and any adjournment or postponement thereof. |

Who is entitled to vote?

Each outstanding share of our common stock entitles its holder to cast one vote on each matter to be voted upon at the annual meeting. Only stockholders of record at the close of business on the record date, February 27, 2020,March 3, 2022, are entitled to receive notice of the annual meeting and to vote the shares of common stock that they held on that date at the meeting, or any postponement or adjournment of the meeting. If your shares are held for you by a beneficial holder in “street name” please refer to the information forwarded to you by your bank, broker or other holder of record to see what you must do to vote your shares. Please see the next question below for a description of a beneficial owner in “street name.”

A complete list of stockholders entitled to vote at the annual meeting will be available for examination by any stockholder at our corporate headquarters, 1212116 South 17th Street, Mattoon, Illinois 61938, during normal business hours for a period of ten days before the annual meeting and at the time and place of the annual meeting.

What is the difference between a stockholder of record and a beneficial holder of shares?

If your shares are registered directly in your name with our transfer agent, Computershare, Inc., you are considered a stockholder of record with respect to those shares. If this is the case, we have provided you with instructions on how to view the proxy materials.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial holder” of the shares held for you in what is known as “street name.” If this is the case, the instructions on how to view the proxy materials have been forwarded to you by your brokerage firm, bank or other nominee, which is considered the stockholder of record with respect to these shares. As the beneficial holder, you have the right to direct your broker, bank or other nominee how to vote your shares. Please contact your broker, bank or other nominee for instructions on how to vote any shares you beneficially own.

Who can attend the meeting?

All stockholders of record as of February 27, 2020March 3, 2022 or their duly appointed proxies, may attend the meeting. Cameras, recording devices and other electronic devices will not be permitted at the meeting. In order to be admitted toTo participate in the annual meeting, you should bring photo identification and proofwill need the 16-digit control number included on your notice of ownershipInternet availability of the Company’s stockproxy materials, on your proxy card or on the record date, February 27, 2020. Ifinstructions that accompanied your proxy materials. The meeting webcast will begin promptly on May 2, 2022 at 9:00 a.m., central time. We encourage you holdto access the meeting prior to the start time. Online check-in will begin at 8:45 a.m., central time, and you should allow time for the check-in procedures.

| How can I attend the annual meeting? |

In light of continued public health concerns regarding the COVID-19 pandemic, this year’s annual meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the annual meeting of stockholders online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/CNSL2022. You also will be able to vote your shares in “street name,” you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the record date and check inelectronically at the registration desk atannual meeting (other than shares held through the meeting.Company’s 401(k) Plan, which must be voted prior to the meeting).

What constitutes a quorum?

A quorum of stockholders is necessary to hold the annual meeting. The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of common stock outstanding on the record date will constitute a quorum. As of February 27, 2020,March 3, 2022, the record date, 71,953,304113,612,846 shares of our common stock were outstanding.

Proxies received but marked as withheld, abstentions, or broker non-votes will be included in the calculation of the number of shares considered present at the meeting for purposes of establishing a quorum. In the event that a quorum is not present at the annual meeting, we expect that the annual meeting will be adjourned or postponed to solicit additional proxies.

How do I vote?

If you are a stockholder of record, you may vote by any of the following methods:

| ·• | Internet.Electronically through the Internet by accessing our materials usingand following the procedures described on the website listed on the Notice. To vote through the Internet, you should sign on to this websiteNotice and follow the procedures described on the website.posted at www.virtualshareholdermeeting.com/CNSL2022. Internet voting is available 24 hours a day, and the procedures are designed to authenticate votes cast by using a personal identification number located on the Notice. These procedures allow you to give a proxy to vote your shares and to confirm that your instructions have been properly recorded. If you received a paper copy of the materials, which will include a proxy card, and you vote through the Internet, you should not return your proxy card. If you vote through the Internet, your proxy will be voted as you direct on the website. |

| ·• | Mail.You can vote by mail by requesting a paper copy of the materials, which will include a proxy card. If you complete and properly sign the proxy card and return it to us, it will be voted as you direct on the proxy card. You should follow the instructions set forth on the proxy card, being sure to complete it, to sign it and to mail it in the enclosed postage-paid envelope. |

| ·• | Telephone. By calling 1-800-690-6903. Telephone voting is available 24 hours a day, and the procedures are designed to authenticate votes cast by using a personal identification number located on the Notice. These procedures allow you to give a proxy to vote your shares and to confirm that your instructions have been properly recorded. If you received a paper copy of the materials, which will include a proxy card, and you vote by telephone, you should not return your proxy card. |

| · | In Person. In person at the meeting. |

We recommend that you vote in advance even if you plan to attend the meeting so that we will know as soon as possible that enough votes will be present for us to hold the meeting. If you are a stockholder of record and attend the meeting, you may vote atonline during the meeting or deliver your completed proxy card in person.meeting.

If your shares are held in “street name,” pleaseyou are considered the “beneficial owner” of those shares. As a beneficial owner, you have the right to direct your broker, trustee or nominee how to vote, or to vote your shares during the annual meeting. You should refer to the information forwarded to you by your bank, broker or other holder of record to see what you must do in order to vote your shares, including whether you may be able to vote electronically through your bank, broker or other record holder. If so, instructions regarding electronic voting will be provided by the bank, broker or other holder of record to you as part of the package that includes this proxy statement. If you are a “street name” stockholder and you wish to vote in person at the meeting, you will need to obtain a proxy from the institution that holds your shares and present it to the inspector of elections with your ballot when you vote at the annual meeting.

Can I revoke or change my vote after I submit my proxy?

Yes. Even after you have submitted your proxy, you may revoke or change your vote at any time before the proxy is voted by:

| · | delivering to our Secretary at the address on the first page of this proxy statement a written notice of revocation of your proxy by mail, by telephone or through the Internet; |

delivering to our Secretary at the address on the first page of this proxy statement a written notice of revocation of your proxy by mail, by telephone or through the Internet; or

| · | delivering a duly executed proxy bearing a later date; or |

| · | voting in person at the annual meeting. |

delivering a duly executed proxy bearing a later date.

If your shares are held in “street name,” you may revoke or change your vote by voting in person at the annual meeting if you obtain a proxy as described in the answer to the previous question.

How many votes are required for the proposals to pass?

Election of Directors (Proposal No. 1).Directors are elected by a plurality vote. Accordingly, the three director nominees who receive the greatest number of votes cast will be elected.

| • | Election of Directors (Proposal No. 1). Directors are elected by a plurality vote. |

Ratification of the Appointment of Ernst & Young LLP (Proposal No. 2), Advisory Vote on Approval of Executive Compensation (Proposal No. 3), and Approval of any Other Proposals. The vote required for each of (i) the ratification of the appointment of Ernst & Young LLP, (ii) the advisory approval of named executive officer compensation and (iii) the approval of any other proposal not presently anticipated that may properly come before the annual meeting or any adjournment or postponement of the meeting, is the approval of a majority of the votes present, in person or by proxy, and entitled to vote on the matter.

| • | Ratification of the Appointment of Ernst & Young LLP (Proposal No. 2). Approval of a majority of the votes present, in person or by proxy, and entitled to vote on the matter. |

| • | Advisory Vote on Approval of Executive Compensation (Proposal No. 3). Approval of a majority of the votes present, in person or by proxy, and entitled to vote on the matter. |

| • | Approval of any Other Proposals Not Presently Anticipated that may Properly Come before the Annual Meeting or any Adjournment or Postponement of the Meeting. Approval of a majority of the votes present, in person or by proxy, and entitled to vote on the matter. |

How are abstentions and broker non-votes treated?

If a stockholder abstains from voting on Proposal No. 2 or Proposal No. 3, it will have the same effect as a vote “AGAINST” that proposal. With respect to Proposal No. 1, abstentions will have no effect. Broker non-votes and shares as to which proxy authority has been withheld with respect to any matter are not entitled to vote for purposes of determining whether stockholder approval for that matter has been obtained and, therefore, will have no effect on the outcome of the vote on any such matter, where it will have the same effect as a vote “AGAINST” that proposal. A broker “non-vote” occurs on a proposal when shares held of record by a broker are present or represented at the meeting but the broker is not permitted to vote on that proposal without instruction from the beneficial owner of the shares and no instruction has been given.

What if I do not specify a choice for a matter when returning a proxy?

Stockholders should specify their choice for each matter when submitting their proxies. If no specific instructions are given, properly submitted proxies will be voted:

| · | “FOR” the election of Robert J. Currey, C. Robert Udell, Jr., and Maribeth S. Rahe as Class III directors (see page 7); |

“FOR” the election of each of the eight directors named in this Proxy Statement to serve until the next annual meeting of stockholders or until their respective successors are elected and qualified (see page 11);

| · | “FOR” the proposal to ratify the appointment of Ernst & Young LLP as our independent auditors (see page 21); and |

“FOR” the proposal to ratify the appointment of Ernst & Young LLP as our independent auditors (see page 25); and

| · | “FOR” the advisory approval of the compensation of the Company’s named executive officers (see page 43). |

“FOR” the advisory approval of the compensation of the Company’s named executive officers (see page 48).

What are the board’s recommendations?

The board’s recommendations, together with the description of each proposal, are set forth in this proxy statement. In summary, the board recommends that you vote:

| · | “FOR” the election of Robert J. Currey, C. Robert Udell, Jr., and Maribeth S. Rahe as Class III directors (see page 7); |

“FOR” the election of each of the eight directors named in this Proxy Statement to serve until the next annual meeting of stockholders or until their respective successors are elected and qualified (see page 11);

| · | “FOR” the ratification of the appointment of Ernst & Young LLP as our independent auditors (see page 21); and |

“FOR” the proposal to ratify the appointment of Ernst & Young LLP as our independent auditors (see page 25); and

| · | “FOR” the approval of the compensation of the Company’s named executive officers (see page 43). |

“FOR” the advisory approval of the compensation of the Company’s named executive officers (see page 48).

Unless you give other instructions otherwise, the Proxy Holders will vote in accordance with the recommendations of the board of directors.

What happens if additional matters are presented at the annual meeting?

Other than the three proposals described in this proxy statement, we are not aware of any other business to be acted upon at the annual meeting.

Pursuant to the provisions of Rule 14a-4(c) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with respect to any other matter that properly comes before the meeting, if you grant a proxy, the persons named as proxy holdersthe Proxy Holders on the enclosed proxy card will vote your shares as recommended by the board of directors or, if no recommendation is given, in their own discretion.

Will anyone contact me regarding this vote?

No arrangements or contracts have been made or entered into with any solicitors as of the date of this proxy statement, although we reserve the right to engage solicitors if we deem them necessary. If done, such solicitations may be made by mail, telephone, facsimile, e-mail, the Internet or personal interviews.

Who will tabulate and certify the vote?

A representative from Broadridge Financial Solutions, Inc. will tabulate the votes and act as Inspector of Elections.

What do I do if I receive duplicate sets of proxy materials?

You may receive more than one set of proxy materials. This duplication will occur if you have shares registered in different names or your shares are in more than one type of account maintained by Computershare, Inc., our transfer agent. To have all your shares voted, you should vote each set of proxy materials you receive.

ANNUAL REPORT

Will I receive a copy of Consolidated’s 20192021 Annual Report to Stockholders?

Our 20192021 Annual Report to Stockholders for the fiscal year ended December 31, 20192021 was made available to stockholders concurrently with this proxy statement. The Notice contains directions for requesting a paper copy of the 20192021 Annual Report to Stockholders and can also be obtained by following the instructions below. The 20192021 Annual Report to Stockholders includes our audited financial statements, along with other financial information about us, which we urge you to read carefully.

How can I receive a copy of Consolidated’s Annual Report on Form 10-K?

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2019,2021, as filed with the SEC on February 28, 2020,March 4, 2022, is included in the 20192021 Annual Report to Stockholders.

You can also obtain, free of charge, a copy of our Annual Report on Form 10-K, including all exhibits filed with it, by:

| ·• | accessing the Investor Relations section of our website athttp://ir.consolidated.com and clicking on the “Financials & Filings” link followed by clicking on the “SEC Filings” link; |

| ·• | accessing the materials online atwww.proxyvote.com; |

writing to:

Consolidated Communications Holdings, Inc. —

Attn: Investor Relations

121

2116 South 17thStreet

Mattoon, Illinois 61938-3987; or

| · | telephoning us at: (844) 909-2675. |

telephoning us at: (844) 909-2675.

You can also obtain a copy of our Annual Report on Form 10-K and other periodic filings that we make with the SEC from the SEC’s EDGAR database atwww.sec.gov.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) AND RISK MANAGEMENT

Our board and management team remain focused on corporate social responsibility and managing environmental, social and governance risks and opportunities. Our board has general oversight responsibility for our risk-management programs and is actively engaged with management in setting the strategic direction of the Company. Our directors provide continual and valuable guidance to management on risk mitigation strategies (see “Corporate Governance and Board Committees - Board oversight of risk” on page 20). In order to maintain effective board oversight of risk across our business, our board delegates certain elements of its oversight function to individual committees. As set forth in its charter, our audit committee supports the board in risk oversight of accounting and financial reporting processes, compliance with legal and regulatory requirements and the oversight of our independent auditors. Our audit committee also monitors enterprise risk-management policies and oversees the responsibilities, performance and effectiveness of the Company’s internal audit function.

For 2021, we published an Environmental, Social and Governance (ESG) report on our website, and we have included a discussion of CSR initiatives and activities in this year’s proxy statement to reinforce our commitment to these matters and demonstrate their importance to our board and management team. Our board also remains committed to constructive engagement with our stockholders. For 2022, we expect to go further with our ESG efforts, focusing more acutely on employee engagement, risk management, environmental sustainability and our larger societal purpose. As part of this initiative, we intend to measure and begin reporting on key ESG metrics more specifically.

Social Responsibility and Human Capital Management

Our board is also engaged in how we attract, develop, retain and manage our employees. As of March 1, 2022, we employed approximately 3,300 employees, including part-time employees. We know that our people are essential to our ability to deliver value to our stockholders, and we strive to create an inclusive environment that reflects the different backgrounds, experiences, ideas and perspectives of our employees. We take great pride in being named a “2021 Best-in-Class Employer” by Gallagher in recognition of our efforts to optimize employee and organizational wellbeing.

We believe it is critical to promote and protect human rights in all the communities we serve, and in our relationships with our employees and vendors. As a long-standing employer and business partner, we strive to foster a work culture that respects and promotes fundamental human rights. Consistent with these goals, we have an established Human and Labor Rights Policy to create awareness and establish expectations related to legal requirements, ethical practices and human rights.

Annually, our board meets to review our succession strategy for key roles, including the role of the CEO, taking into account our key priorities and long-term business strategy. CEO succession planning discussions are led by the chair of our corporate governance committee, and discussions and planning takes place with our entire board. Our directors have direct access to and interaction with members of the senior management team, and our board is regularly updated on matters involving our workforce and workplace culture as part of its oversight role.

Integrity and Ethical Business Conduct

We place the highest value on the integrity of our directors, officers and employees and we require integrity and ethical conduct in the workplace and in our business transactions. We insist on ethical dealings with others and on the ethical handling of actual or apparent conflicts of interest within personal and professional relationships. When an ethical issue or concern needs to be addressed in the workplace, we attempt to foster a work environment where discussions can take place without the fear of retribution and also provide a system of reporting and access for anyone who wishes to report a suspected violation. Directors, officers and employees are required to deal honestly and fairly with our customers, collaborators, competitors and other third parties. In our dealings with customers and suppliers, we prohibit making or receiving bribes, kickbacks or any other improper payments, direct or indirect, to any representative of government, labor union, customer or supplier in order to obtain a contract, commercial benefit or government action. We also ask our vendors and suppliers to adhere to the same standards of legal and ethical business conduct. We are committed to doing business with suppliers and vendors in a way that positively influences our strategic and operational goals, complies with applicable laws and regulations, provides high-quality goods and services, delivers exceptional customer service and offers competitive pricing.

Diversity and Inclusion

We embrace diversity and inclusion (D&I) and seek to hire and retain high-quality employees of all backgrounds and experiences. We believe diversity of backgrounds contributes to different ideas, which in turn drives better results for our customers and our stockholders. We respect differences and diversity as qualities that enhance our efforts as a team and believe embracing diversity and a culture of inclusion makes our company a better place to work. In accordance with these core values, we are committed to pursuing greater diversity in the workplace and in positions of leadership as we strive to create a work environment that provides equal access to information, development and opportunity. In 2021, we formed an employee diversity council as part of an enhanced and comprehensive employee engagement initiative, and we partnered with diversity and veteran-focused job sites to attract a larger and more diverse pool of job candidates. Our employees completed approximately 3,000 hours of training on discrimination and harassment prevention on topics that included ageism, anti-bullying and respect for people from other racial, ethnic and religious groups. We built upon our D&I initiatives from last year and conducted diversity training for our executive team and other senior leaders. As we look ahead, we are actively working to help advance our diversity journey and build upon our practices on diversity, inclusion and fairness.

Safe, Healthful and Secure Workplace

We also strive to create and provide a safe, healthful and secure workplace that is free from discrimination or harassment. Our workplace policies and procedures protect against behavior that creates an offensive, hostile, or intimidating work environment. Physical harm or threats, direct or implied, and illegal acts of harassment, including sexual harassment, are violations of our Code of Business Conduct and are not tolerated. We recruit, hire, assign and promote without regard to race, color, religion, sex, age, national origin, disability or any other factor prohibited by law. We also reasonably accommodate qualified applicants with covered disabilities who can perform the essential functions of the job with or without reasonable accommodations. Safety is a top priority and we have a strong, ongoing commitment to ensure employees are properly trained and have appropriate safety and emergency equipment. We continued to make extraordinary efforts to keep our employees safe in 2021 during the COVID-19 pandemic, as well as provide employees with proper general environmental health and safety training, and relevant training on work-related hazards they may experience. At Consolidated, pandemics are included as part of our emergency operations plan and preparedness training. Since the onset of the COVID-19 pandemic, we have continued to institute the following measures: providing field employees with all required personal protective equipment; enforcing a face covering policy in accordance with CDC guidelines; transitioning employees to remote work; increased sanitation of company buildings and work spaces; restricting non-essential travel; encouraging vaccination; and requiring all employees to complete online COVID-19 safety training. In addition, we developed a portal for COVID-19 support and resources for our customers, with updates on the company’s safety measures and pandemic response.

In 2021, recurring yearly certifications for mandatory, legally compliant, workplace harassment trainings were established within the company’s online employee training system. Our employees completed nearly 30,000 safety and human resource compliant training modules. We believe that our efforts to reduce the number of accidents and injuries by refining targeted safety training paid off, as our rate of worker’s compensation claims dropped by 16% year-over-year. In conjunction with our fiber expansion plans, we updated our Code of Safety Practices for our contractors to help ensure the health and safety of all employees, customers and our communities.

Commitment to Our Communities

We also believe that extending safe and responsible work habits into the communities we serve help to make them better places to live and work. We value the principles that guide and inspire us to be a good neighbor, deliver reliable services and products, and connect people in all that we do, every day. For more than 125 years, we have forged a strong legacy and tradition of philanthropy and volunteerism within the communities we serve. We believe engaging in and supporting the community improves the quality of life and creates a more vibrant place to live and work.

In 2021, we provided more than $1.4 million in support to nearly 350 community non-profits and organizations through our company giving programs, educational grant program, foundation grants, economic development initiatives, community events and sponsorship. Some highlights include: $60,000 given as part of our Consolidated Connects program to 20 different schools to promote creative learning and digital literacy; $170,000 to non-profits in Minnesota as part of our Minnesota Community Fund; and over $111,000 to organizations in California supporting essential and critical community needs like fighting hunger and homelessness. For our efforts, we were honored to make the Sacramento Business Journals list of top 10 Corporate Philanthropic Foundations. Also, as part of our fiber expansion, we invested over $364 million in broadband development in rural communities across our markets.

In 2021, our employees reported 4,000 volunteer hours, despite ongoing limitations associated with the COVID-19 pandemic. In recognition of their volunteerism, we award distinguished employees who are committed to corporate stewardship and supporting the communities we serve with Community Service Awards.

Environmental Sustainability

Our employees are also proud to serve our customers, investors, business partners, and communities as good stewards of the Earth and the environment. We are committed to operating a sustainable business and mitigate the impact we have on the planet and our natural environment. Our executives play an active role in overseeing responsible environmental practices and programs, and our board of directors is advised on our management of ESG initiatives. We continue to find sensible ways to minimize waste in our offices and facilities. The turnover of outdated customer equipment and network materials is a unique challenge for our business, and we believe in the importance of addressing this issue with an effective recycling program. In the field, wire and equipment is processed and sorted for shipment to approved recyclers. Through the proper disposal of old computers and office technology products, to the recycling of cardboard, paper, electronics, glass, plastic, aluminum and other items at our primary offices and larger administrative locations, we hope to contribute positively to sustainability. Recognizing the impact waste can have on the communities we serve, we provide consumer education on the value of recycling phone directories, offer recycle bins and promote local recycling events. Our phone directories are printed on recycled paper and include an option for customers to opt-out of receiving future directories, further reducing their environmental impact. Customers also have the option to enroll in paperless billing, which we promote as a way to reduce waste. We comply with state, federal and local laws related to hazardous waste and, when necessary, hire certified and compliant waste disposal companies to dispose of materials in a safe and environmentally friendly manner.

Our investments in energy conservation and efficiency reflect our aspirations to reduce the impact our energy use has on the environment. In our buildings and facilities, important steps have been taken to reduce our energy consumption, including: updating boilers and HVAC systems with high-efficiency units; adding motion-sensitive and/or LED lighting in office areas; employing active-monitoring of our heating and cooling facilities to adjust to changes in ambient temperature and humidity; and reducing the footprint of our network and computing systems by upgrading our legacy power systems in our central offices with new, high efficiency T-Box rectifiers that utilize less energy and generate less heat. In 2021, the beginning stages of a program was initiated to replace fluorescent lighting in our buildings with more efficient LED bulbs utilizing newer technology. Our objective is to extend this program to address company locations in all markets, including central offices, garages, administrative buildings and outside plant network huts. The new bulbs are expected to be 64% more efficient than the fluorescent bulbs currently in place and 30% more efficient than our existing LED lighting.

We are aware of global climate change and want to take advantage of areas where we can make a positive impact by reducing emissions. In markets where it is available, we are in the process of pursuing solar offset energy for a portion of our power use. In Maine, we have entered into a program to participate in a community solar project that will reduce the amount of carbon-based energy required to supply the energy needs of our northern Maine locations. More projects of this nature are in the planning stages for southern Maine, Minnesota and other markets.

We believe it is important to know where we stand in terms of energy and resource usage, and we have historically tracked such usage. To provide transparency to stakeholders and the public, we provided for the first time this year quantitative metrics that show our approximate resource usage in our annual ESG Report, available through our website. In an effort to reduce transportation and fuel-related emissions, we encourage employees to limit air and automobile travel and encourage the use of technology solutions, such as video or phone conferencing, when possible. We have also begun efforts to supplement our fleet with more fuel-efficient vehicles that emit less carbon, instituting a policy to purchase vehicles equipped with at least flex-fuel technology. In our Northern New England market, we added all-electric vehicles to our fleet and plan to continue this in 2022.

Through the utilization of Voice over Internet Protocol (VoIP), the need for travel by business customers is reduced as the service allows for effective and productive telecommuting options. Additionally, the need for traditional cable set-top boxes that contribute to carbon emissions and energy use is eliminated through our use of proprietary and third-party over-the-top (OTT) television platforms and solutions. By working with business partners who also embrace green initiatives and the conservation of natural resources, we strive to balance environmental and fiscal responsibilities when making purchasing decisions. By educating our employees and customers on environmental issues and our sustainability initiatives and providing them with information on how they can put environmentally friendly practices in place at home and work, we are able to establish and maintain a culture of awareness and action.

Expanding Broadband Deployment

We are also committed to expanding broadband deployment and providing all Americans with digital opportunity, striving to bridge the “digital divide” in our country. As part of our plan to deliver fiber to the home to more than 70% of our service area by 2025, we invested over $364 million in broadband development to unserved and underserved rural communities, an investment we hope will go a long way towards bridging the Rural Digital Divide. Our multi-year fiber build plan, our pursuit of public-private partnerships in rural areas and our ongoing participation in federal and state broadband subsidy programs such as the Connect America Fund (CAF) Phase II Program and the Rural Digital Opportunity Fund (RDOF) are examples of our commitment to investing in and expanding our network to unserved and underserved communities. In 2021, our public-private partnerships in New England resulted in an additional 20,000 passings to towns in New Hampshire and Maine. We continue to offer eligible low-income residential customers the opportunity to participate in the FCC’s Lifeline Program, which allows subscribers to receive a monthly discount on voice and qualifying Internet services.

Data Security and Protection

The safeguarding of our customers’ personal information is of the highest importance to us. We do not sell, rent or disclose personally identifiable information to any third party for marketing purposes or other reasons that are not related to rendering the services we provide to our subscribers (or activities related to our services), except as required by applicable law or with the customer’s consent. See our privacy policy (www.consolidated.com/privacy) to learn more about how we protect our customers’ personal information.

As a data privacy champion, we provide ongoing consumer education on how to protect our customers’ personal data and, more broadly, how to keep our customers and their families safe online. We also recognize and support the principle that all organizations share the responsibility of being conscientious stewards of personal information and we have undertaken significant efforts to educate our customers, employees and communities on safe online practices. Internally, our employees are kept abreast of the latest cybersecurity risks and threats and are regularly provided with educational content and information to minimize risks to our network and business systems. We maintain and regularly update actionable tips on online safety and data privacy practices at www.consolidated.com/staysafeonline.

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information that has been provided to us with respect to the beneficial ownership of shares of our common stock for (i) each stockholder who is known by us to own beneficially more than 5% of the outstanding shares of our common stock, (ii) each of our directors, (iii) each of our executive officers named in the Summary Compensation Table on page 38,41, and (iv) all of our current directors and executive officers as a group. Unless otherwise indicated, each stockholder shown on the table has sole voting and dispositive power with respect to all shares shown as beneficially owned by that stockholder. Unless otherwise indicated, this information is current as of February 27, 2020,March 3, 2022, and the address of all individuals listed in the table is as follows: Consolidated Communications Holdings, Inc., 1212116 South 17th Street, Mattoon, Illinois 61938-3987.61938.

| | | | Aggregate Number of | | | | |

| | | | Shares Beneficially | | Percentage of Shares | |

| Name of Beneficial Owner | | Aggregate Number of Shares Beneficially Owned | | Percentage of Shares Outstanding | | Owned | | Outstanding | |

| | | |

| BlackRock Institutional Trust Company, N.A.(a) | | 11,877,393 | | 16.5% | |

| The Vanguard Group, Inc.(b) | | 6,016,202 | | 8.3% | |

| Dimensional Fund Advisors LP(c) | | 5,019,514 | | 7.0% | |

| Private Management Group, Inc.(d) | | 4,666,300 | | 6.5% | |

| Robert J. Currey | | 139,335 | | * | |

| Searchlight III CVL, L.P.(a) | | | | 39,338,753 | | | | 34.6 | % |

| BlackRock Institutional Trust Company, N.A.(b) | | | | 11,621,193 | | | | 10.2 | % |

| The Vanguard Group, Inc.(c) | | | | 6,030,338 | | | | 5.3 | % |

| Dimensional Fund Advisors LP(d) | | | | 4,456,988 | | | | 3.9 | % |

| Private Management Group, Inc.(e) | | | | 3,612,786 | | | | 3.2 | % |

| C. Robert Udell, Jr. | | 314,716 | | * | | | 811,308 | | | | * | |

| Steven L. Childers | | 166,012 | | * | | | 390,342 | | | | * | |

| Robert J. Currey | | | | 207,513 | | | | * | |

| Thomas A. Gerke | | 45,543 | | * | | | 86,021 | | | | * | |

| Dale E. Parker | | 42,449 | | * | |

| Maribeth S. Rahe | | 65,183 | | * | | | 115,661 | | | | * | |

| Timothy D. Taron | | 57,233 | | * | |

| Marissa M. Solis | | | | 0 | | | | * | |

| Roger H. Moore | | 59,750 | | * | | | 100,228 | | | | * | |

| Wayne Wilson | | 72,622 | | * | |

| Andrew S. Frey | | | | 0 | | | | * | |

| David G. Fuller | | | | 22,088 | | | | * | |

| All directors & executive officers as a group (9 persons) | | 962,843 | | 1.3% | | | 1,733,161 | | | | 1.5 | % |

* Less than 1.0% ownership

| (a) | Beneficial and percentage ownership information is based on information contained in a FormSchedule 13D/A filed with the SEC on December 21, 2021, by Searchlight III CVL, L.P. The address of Searchlight III CVL, L.P is c/o Searchlight Capital Partners, L.P., 745 5th Avenue – 27th Floor, New York, New York 10151. Searchlight III CVL, L.P has sole voting power with respect to 39,338,753 shares and sole dispositive power with respect to 39,338,753 shares. |

| (b) | Beneficial and percentage ownership information is based on information contained in a Schedule 13G/A filed with the SEC on February 4, 2020,January 28, 2022, by BlackRock, Inc. The address of BlackRock, Inc. is 55 East 52nd Street, New York, New York 10055. BlackRock, Inc. has sole voting power with respect to 11,619,84211,463,850 shares and sole dispositive power with respect to 11,877,39311,621,193 shares. |

| (b)(c) | Beneficial and percentage ownership information is based on information contained in a FormSchedule 13G/A filed with the SEC on February 12, 2020,9, 2022, by The Vanguard Group, Inc. The address of The Vanguard Group, Inc. is 100 Vanguard Blvd., Malvern, Pennsylvania 19355. The Vanguard Group has sole voting power with respect to 70,177zero shares, shared voting power with respect to 21,38376,708 shares, sole dispositive power with respect to 5,935,4965,898,561 shares, and shared dispositive power with respect to 80,706131,777 shares. |

| (c)(d) | Beneficial and percentage ownership information is based on information contained in a FormSchedule 13G/A filed with the SEC on February 12, 2020,14, 2022, by Dimensional Fund Advisors LP. The address of Dimensional Fund Advisors LP is Building One, 6300 Bee Cave Road, Austin, Texas 78746. Dimensional Fund Advisors LP has sole voting power with respect to 4,831,6514,346,561 shares and sole dispositive power with respect to 5,019,5144,456,988 shares. |

| (d)(e) | Beneficial and percentage ownership information is based on information contained in a Form 13GSchedule 13G/A filed with the SEC on February 7, 2020,10, 2022, by Private Management Group, Inc. The address of Private Management Group, Inc. is 15635 Alton Parkway, Suite 400, Irvine, California 92618. Private Management Group, Inc. has shared sole voting power with respect to 4,666,3003,612,786 shares and sole dispositive power with respect to 4,666,3003,612,786 shares. |

PROPOSAL NO. 1 — THE ELECTION OF ROBERT J. CURREY, C. ROBERT UDELL, JR.,EACH OF THE EIGHT DIRECTORS NAMED IN THIS

PROXY STATEMENT TO SERVE UNTIL THE NEXT ANNUAL MEETING OF STOCKHOLDERS OR

UNTIL THEIR RESPECTIVE SUCCESSORS ARE ELECTED AND MARIBETH S. RAHE AS DIRECTORSQUALIFIED

Our board of directors consists of eight directors. Our amendedIn accordance with our Amended and restated certificateRestated Certificate of incorporation provides for the classification ofIncorporation and Amended and Restated Bylaws, our board of directors into three classes of directors, designated Class I, Class II and Class III, as nearly equal in size as is practicable, serving staggered three-year terms. One class of directors isare elected each year to hold office for a three-year term or until successors of such directors are duly elected and qualified.one-year term. The board, including the corporate governance committee, has recommended, and the board also recommends,proposed that the stockholders elect Mr. Currey, Mr. Udell, and Ms. Rahe,following eight nominees be elected at the nominees designated below as the Class III directors, at this year’s annual meeting, to serve for a termeach of three years, expiring in 2023 orwhom will hold office until the next annual meeting and until his or her respective successor is dulyshall have been elected and qualified. The nominees for election to the position of Class III directors, and certain information with respect to their backgrounds and the backgrounds of non-nominee directors, are set forth below.qualified:

It is the intention of the Proxy Holders, unless otherwise instructed, to vote to elect theDirector nominees named herein as the Class III directors. The nominees named herein presently serve on our board of directors, and each nominee has consented to serve as a director if elected at this year’s annual meeting. In the event that any of the nominees named herein is unable to serve as a director, discretionary authority is reserved to the board to vote for a substitute for such nominee. The board has no reason to believe the nominees named herein will be unable to serve if elected.

Nominees standing for election to the board

| Name | | Age | | Current Position with Consolidated Communications |

| | | | |

RobertRobert. J. Currey | | | | |

(Class III Director – term expiring in 2023) | | 7476 | | Chairman of the Board and Director |

| Andrew S. Frey | | 46 | | Director |

| David G. Fuller | | 55 | | Director |

| Thomas A. Gerke | | 65 | | Director |

| Roger H. Moore | | 80 | | Director |

| Maribeth S. Rahe | | | | |

(Class III Director – term expiring in 2023) | | 7173 | | Director |

| Marissa M. Solis | | 49 | | Director |

| C. Robert Udell, Jr. | | | | |

(Class III Director – term expiring in 2023) | | 5456 | | President & Chief Executive Officer and Director |

Directors continuing to serve on the board

Name | | Age | | Current Position with Consolidated Communications |

| | | | |

Timothy D. Taron | | | | |

(Class I Director – term expiring in 2021) | | 69 | | Director |

| | | | |

Wayne Wilson | | | | |

(Class I Director – term expiring in 2021) | | 71 | | Director |

| | | | |

Thomas A. Gerke | | | | |

(Class II Director – term expiring in 2022) | | 63 | | Director |

| | | | |

Roger H. Moore | | | | |

(Class II Director – term expiring in 2022) | | 78 | | Director |

| | | | |

Dale E. Parker | | | | |

(Class II Director – term expiring in 2022) | | 68 | | Director |

Set forth below is information with respect to theour director nominees to the board and each continuing director regarding their experience. After the caption “Board Contributions,” we describe some of the specific experience, qualifications, attributes or skills that led to the conclusion that the person should serve as a director for the Company.

Business experience of nominees to the boardcontinuing directors

Robert J. Curreyserves as our Chairman of the board of directors. Mr. Currey has served as one of the Company’s directors and as a director of our predecessors since 2002 and served as our CEO from 2002 until December 31, 2014. From 2002 to November 2013, he also served as our President. From 2000 to 2002, Mr. Currey served as Vice Chairman of RCN Corporation, a competitive telephone company providing telephony, cable and Internet services in high-density markets nationwide. From 1998 to 2000, Mr. Currey served as President and CEO of 21st Century Telecom Group. From 1997 to 1998, Mr. Currey served as Director and Group President of Telecommunications Services of McLeodUSA, which acquired our predecessor in 1997. Mr. Currey joined our predecessor in 1990 and served as President through its acquisition in 1997.

Board Contributions:Mr. Currey is a long-time, industry veteran and has significant experience leading other companies in the telecommunications and media sector. He is well known throughout the telecommunications industry and is respected as an opinion leader especially among mid-sized telecom carriers. Because of his experience and his role as our former CEO until December 31, 2014, Mr. Currey also has substantial knowledge of the Company, including its operations and strategies.

C. Robert Udell, Jr.Andrew S. Frey serves as joined our Presidentboard in December 2021 and CEO and asis a director. Mr. Udell served as Chief Operating Officer from May 2011 to December 31, 2014, and as President from November 2013 until December 31, 2014. He became President and CEO on January 1, 2015. He has served aspartner at Searchlight Capital Partners, a director since November 2013. From 1999 to 2004, Mr. Udell served in various capacities at the predecessor of our Texas operations, including Executive Vice President and Chief Operating Officer. From 2004 to November 2013, Mr. Udell served as Senior Vice President.global private equity firm. Prior to joining the predecessor of our Texas operationsSearchlight in March 1999,2011, Mr. UdellFrey was employed by our predecessor from 1993 to 1999 in a variety of senior roles, including Senior Vice President, Network Operations,managing principal at Quadrangle Group where he primarily focused on telecommunications and Engineering. Hetechnology investments. Mr. Frey serves as the former Vice Chair and Chairman of the board of director of the USTelecom Association and is on the board of directors of each of Mitel Networks Corporation, Ziply Fiber, LLC and Global Risk Partners Limited. Mr. Frey received a B.S. in finance and B.A.S. in systems engineering from the Greater Conroe Economic Development Council. He is also a former board memberUniversity of the Board of Trustees for The John Cooper School.

Board Contributions: Mr. Udell has been in the telecommunications industry for more than 25 years, and has worked in a number of capacities. He brings a broad knowledge of our operating environment, key trends in technology and regulation, and market forces impacting the Company. Because of his role as President and CEO of the Company, he is also able to provide the board with in-depth insight into the Company’s current performance and future plans.Pennsylvania.

Maribeth S. RaheBoard Contributions: Mr. Frey has substantial experience working with public and private telecommunications and technology companies. We believe Mr. Frey is qualified to serve on our board due to his deep knowledge of the industry, his extensive understanding of equity and debt capital markets, as well as his current and past positions on other boards, including his prior service as a board observer of the Company.

hasDavid G. Fuller joined our board in October 2020, and is an Operating Partner with Searchlight Capital Partners, a private equity firm, where he plays an advisory role to their Technology, Media and Telecom practice. From March 2021 to January 2022, Mr. Fuller served as the President of Rogers Wireless, Canada’s largest mobile operator, a director since July 2005. Ms. Rahe haspart of Rogers Communications Inc., a Canadian communications and media company. Previous to this, he was a Senior Advisor to the global Technology, Media and Telecom practice of Boston Consulting Group. From 2014 until January 2019, Mr. Fuller was an Executive Vice-President of TELUS Corporation, a Canadian telecommunications company, and President, TELUS Consumer and Small Business Solutions. He previously served as Presidentthe Chief Marketing Officer of TELUS from 2009 to 2014 and CEOthe Senior Vice-President, Business Solutions Marketing from 2004 to 2009. Prior to joining TELUS, Mr. Fuller spent 15 years in the management consulting industry with a number of Fort Washington Investment Advisors, Inc. since November 2003. Ms. Rahefirms, culminating in the country managing partner role at KPMG Consulting. Mr. Fuller is currently a member of the board of directors of First Financial BancorpGreat-West Lifeco and First Financial Bank. From January 2001 to October 2002, Ms. Rahe was Presidentof Mitel Networks. Mr. Fuller previously served as a director of MindBeacon Holding Inc., Enstream LP and the Ontario Science Centre. Mr. Fuller is a Professional Engineer and holds a MBA from the Schulich School of Business at York University and a memberBachelor of the board of directors of U.S. Trust Company of New York, andApplied Science in Engineering from June 1997 to January 2001, was its Vice Chairman and a member of the board of directors.Queen’s University.

Board Contributions: Ms. Rahe hasMr. Fuller is a seasoned executive and business advisor with substantial experience in all aspects of the telecommunications industry. He brings an in-depth knowledge of our sector and contributes critical skills and knowledge of marketing, sales and operations to our board, as well as a deep background as a senior executive in the banking industrybroadband and is well attunedwireless technologies. Mr. Fuller’s contributions to developments in the capital markets and their potential impact on the Company. She provides a strong risk-management perspective and oversees the board’s succession planning efforts. She also qualifies as an “audit committee financial expert” under SEC guidelines and serves as our audit committee chairperson.

Business experience of continuing directors

Timothy D. Taron has served as a director since July 2012. Mr. Taron, a practicing attorney for over 40 years, served on the board of directors of SureWest Communications (“SureWest”) from 2000 until the consummation of the Company’s merger with SureWest on July 2, 2012. Mr. Taron is the senior partner with the law firm of Hefner Stark & Marois, LLP, Attorneys-at-Law, Sacramento, California. He was formerly the President and a director of the Sacramento Metropolitan Chamber of Commerce, a private, non-profit organization.

Board Contributions: Mr. Taron, a practicing attorney for over 40 years with a firm located in our Sacramento service area, specializes in complex business transactions, real estate development and tax-exempt bond financing, providing the board with the ability to analyze a variety of business matters. Hisare further augmented by both his extensive involvement in the Sacramento business community, coupled with his hands-on experience in areas affecting the growth and health of the economy in the community in which he resides and practices law, provides the board with better insight into the markets the Company principally serves and its potential business opportunities. Mr. Taron is well suited for the corporate governance committee chair position due to his past involvement on public and non-profit boardsprivate board experiences across a number of industries, and his training and continuing education as an attorney.

Wayne Wilson joined our board of directors in July 2017 in connection with our acquisition of FairPoint Communications, Inc. (“FairPoint”). He had served on the FairPoint board of directors since 2011. Mr. Wilson has been an independent business advisor since 2002. From 1995 to 2002, Mr. Wilson served in various roles as President, Chief Operating Officer and Chief Financial Officer of PC Connection, Inc., a Fortune 1000 direct marketer of information technology products and services. From 1986 to 1995, Mr. Wilson was a partner in the assurance and advisory services practice of Deloitte & Touche LLP. He previously served as a director of ARIAD Pharmaceuticals, Inc., Edgewater Technology, Inc., Hologic, Inc. and Cytyc Corporation. Mr. Wilson received a Bachelor of Arts degree in political science from Duke University and a Master of Business Administration degree from the University of North Carolina at Chapel Hill. He is a certified public accountant in New Hampshire and North Carolina.

Board Contributions: We believe Mr. Wilson’s qualifications to serve on our board include his strong accounting and finance understanding gained from years as a certified public accountant in industry and with a major public accounting firm. Mr. Wilson qualifies as an “audit committee financial expert” under SEC guidelines and hasextensive experience as a director on the boards of multiple publicly-traded companies. Mr. Wilson is a resident of New Hampshiremanagement consultant and his prior service on FairPoint’s board provides him with a unique understanding of our important northern New England markets.technology executive.

Thomas A. Gerkehas served as a director since February 2013 and2013. Mr. Gerke is the General Counsel and Chief Administrative Officercurrently a Sr. Vice President at H&R Block, a global consumer tax services provider. Since joiningprovider, and served as its General Counsel and Chief Administrative Officer from January 2012 to January 2022. At H&R Block, in January 2012, at various times Mr. Gerke has had additionala number of other roles and responsibilities, including leadership of the human resources function and serving as interim Chief Executive Officer. From January 2011 to April 2011, Mr. Gerke served as Executive Vice President, General Counsel and Secretary of YRC Worldwide, a Fortune 500 transportation service provider. From July 2009 to December 2010, Mr. Gerke served as Executive Vice Chairman of CenturyLink, a Fortune 500 integrated communications business. From December 2007 to June 2009, he served as President and CEO at Embarq, then a Fortune 500 integrated communications business. He also held the position of Executive Vice President and General Counsel – Law and External Affairs at Embarq from May 2006 to December 2007. From October 1994 through May 2006, Mr. Gerke held a number of executive and legal positions with Sprint, serving as Executive Vice President and General Counsel for over two years. Mr. Gerke is alsocurrently a member of the Board of Directors of MGP Ingredients, Inc. (NASDAQ: MPGI) and is a former director of CenturyLink, Embarq, and the USTelecom Association.Association and Tallgrass Energy GP, LCC, the General Partner of Tallgrass Energy, LP (NYSE: TGE), a provider of natural gas transportation and storage services. In addition, he is a former member of the Rockhurst University Board of Trustees and The Greater Kansas City Local Investment Commission Board of Trustees. He currently serves as a board member of Tallgrass Energy GP, LCC, the General Partner of Tallgrass Energy, LP (NYSE: TGE), a provider of natural gas transportation and storage services.

Board Contributions: Mr. Gerke has substantial experience in the telecommunications sector. His leadership and industry experiences bring a strong and knowledgeable operational and strategic perspective to the board’s deliberations. He also brings perspective from service on other boards. Although Mr. Gerke is not currently a member of our audit committee, he also qualifies as an “audit committee financial expert” under SEC guidelines.

Roger H. Moorehas served as a director since July 2005. Mr. Moore was President and Chief Executive Officer of Illuminet Holdings, Inc., a provider of network, database and billing services to the communications industry, from October 1998 to December 2001, a member of its board of directors from July 1998 to December 2001, and its President and CEO from January 1996 to August 1998. In December of 2001, Illuminet was acquired by VeriSign, Inc. and Mr. Moore retired at that time. From September to October 1998, he served as President, CEO and a member of the board of directors of VINA Technologies, Inc., a telecommunications equipment company. From June 2007 to November 2007, Mr. Moore served as interim President and CEO of Arbinet. From December 2007 to May 2009, Mr. Moore served as a consultant to VeriSign, Inc. Mr. Moore also presently serves as a director of VeriSign, Inc. and was previously a director of Western Digital Corporation.

Board Contributions: Mr. Moore is a seasoned telecommunications executive with a deep background in the industry and very strong technical aptitude. He has a strong entrepreneurial bent and is a knowledgeable analyst of the evolution of telecommunications and the impact of new technologies on our business. He brings perspective from service on other boards. Although Mr. Moore is not currently a member of our audit committee, he also qualifies as an “audit committee financial expert” under SEC guidelines.

Dale E. ParkerMaribeth S. Rahe has served as a director since October 2014. Mr. Parker wasJuly 2005. Ms. Rahe has served as President and CEO of Fort Washington Investment Advisors, Inc. since November 2003. Ms. Rahe is currently a member of the board of directors of Enventis Corporation (formerly Hickory Tech) from 2006 until the consummationFirst Financial Bancorp and First Financial Bank. From January 2001 to October 2002, Ms. Rahe was President and a member of Enventis Corporation’s merger with the Company on October 16, 2014, and served as Chair of Enventis Corporation’s board from January 2011 to May 2013. Mr. Parker was on the board of directors of Image Sensing Systems, Inc. from August 2012 through June 2016, where he also served as interim CEO from December 2014 through June 2016, as well as, COOU.S. Trust Company of New York, and CFO from June 2013 through June 2016. Image Sensing Systems, Inc. is1997 to January 2001, was its Vice Chair and a technology company focused on infrastructure improvement throughmember of the developmentboard of software-based detection solutions for the intelligent transportation sector. Mr. Parker serveddirectors.

Board Contributions: Ms. Rahe has a deep background as interim CFO for Ener1, Inc. from 2011 to 2012. Ener1, Inc. is an energy storage technology company that develops lithium-ion-powered storage solutions for applicationa senior executive in the electric utility, transportationbanking industry and industrial electronics markets. In 2010, Mr. Parker worked as CFO of Neenah Enterprises, Inc., an independent foundry. From 2009is well attuned to 2010, Mr. Parker wasdevelopments in the Vice President of Finance for Paper Works,capital markets and their potential impact on the Company. She provides a producer of coated recycled paper board. Mr. Parker was CFO at Forest Resources, LLC, a company focused on paper product productionstrong risk-management perspective and conversion, from 2007 to October 2008. Mr. Parker is a certified public accountant and holds an MBA.

Board Contributions: Mr. Parker has extensive experience working in senior executive positions for both public and private companies across a variety of industries, and expertise with financial statement preparation and SEC reporting gained from his experience as a CFO. Mr. Parkeroversees the board’s succession planning efforts. She also qualifies as an “audit committee financial expert” under SEC guidelines. Further, havingguidelines and serves as our audit committee chair.

Marissa M. Solis joined our board in January 2022 and currently serves as the Senior Vice President of Global Brand and Consumer Marketing at the National Football League. Prior to this, Ms. Solis spent 18 years at Pepsico where she held numerous marketing leadership roles in brand marketing, portfolio marketing, partnerships and omnichannel media. She served as the past ChairSenior Vice President at Pepsico's Frito Lay North America Division from October 2019 to November 2021 and prior to that role served as Vice President and General Manager of the Enventis CorporationHispanic Business Unit at Pepsico Beverages North America from October 2017 to October 2019. Prior to joining Pepsico, Ms. Solis was a management consultant at Deloitte Consulting from September 2000 to November 2003. She began her career in 1995 as a Brand Manager in Procter & Gamble Latin America. Ms. Solis holds her master’s degree in public administration and public affairs from the University of Texas at Austin and her bachelor’s degree in international economics from Georgetown University.

Board Contributions: Ms. Solis has significant experience leading consumer marketing, advertising and brand strategy initiatives. Because she has served in a variety of roles focused on product innovation and the customer experience, we believe she will be a valuable asset for the Company as we execute on our fiber growth plan and continued transformation. We also believe Ms. Solis’s substantial experience with consumer marketing and branding, including the creation of business strategies for core brands, will be complementary to and balance the knowledge of our other Board members.

C. Robert Udell, Jr. serves as our President and CEO and as a director. Mr. Udell served as Chief Operating Officer from May 2011 to December 31, 2014, and as President from November 2013 until December 31, 2014. He became President and CEO on January 1, 2015. He has served as a director since November 2013. From 1999 to 2004, Mr. Udell served in various capacities at the predecessor of our Texas operations, including Executive Vice President and Chief Operating Officer. From 2004 to November 2013, Mr. Udell served as Senior Vice President. Prior to joining the predecessor of our Texas operations in March 1999, Mr. Udell was employed by our predecessor from 1993 to 1999 in a variety of senior roles, including Senior Vice President, Network Operations and Engineering. He serves as the former Vice Chair and Chairman of the board of directors of the USTelecom Association and living and workingis on the board of the Greater Conroe Economic Development Council. He is also a former member of the Board of Trustees for The John Cooper School.

Board Contributions: Mr. Udell has been in the Minneapolis-St. Paul market, Mr. Parkertelecommunications industry for more than 25 years and has worked in a number of capacities. He brings an in-deptha broad knowledge of our operating environment, key trends in technology and regulation, and market forces impacting the Company. Because of his role as President and CEO of the Company, he is also able to provide the board with in-depth insight into the Company’s acquired Minnesota operationscurrent performance and the business climate in which the Company operates.future plans.

Business experience of continuing executive officer

The following is a description of the background of our continuing executive officer who is not a director:

Steven L. Childersserves as CFO and Treasurer of the Company. Mr. Childers has served as CFO since April 2004 and as Treasurer since October 2019 and also served as CFO and Treasurer from November 2016 to October 2017. From April 2003 to April 2004, Mr. Childers served as Vice President of Finance. From January 2003 to April 2003, Mr. Childers served as the Director of Corporate Development. From 1997 to 2002, Mr. Childers served in various capacities at McLeodUSA, including as Vice President of Customer Service, Vice President of Sales and as a member of its Business Process Teams, leading an effort to implement new revenue assurance processes and controls. Mr. Childers joined the Company’s predecessor in 1986 and served in various capacities through its acquisition by McLeodUSA in 1997, including as President of its former Market Response division and in various finance and executive roles. Mr. Childers is a director for the Sarah Bush Lincoln Health Center the Lake Land College Foundation and serves as Chairman of its Finance, Audit and Compliance committee. He is also a member of the Business Advisory Board for Eastern Illinois University. He is a former director of the Illinois State Chamber of Commerce, served as Treasurer and was a member of the Executive Committee.

Board recommendation and stockholder vote required

The board of directors recommends a vote “FOR” the election of each of the director nominees named aboveRobert J. Currey, Andrew S. Frey, David G. Fuller, Thomas A. Gerke, Roger H. Moore, Maribeth S. Rahe, Marissa M. Solis and C. Robert Udell, Jr. (Proposal No. 1).

The affirmative vote of a plurality of the votes cast at the meeting at which a quorum is present is required for the election of each of the eight director nomineenominees named above.

CORPORATE GOVERNANCE AND BOARD COMMITTEES

Are a majority of the directors independent?

Yes. The corporate governance committee undertook its annual review of director independence and reviewed its findings with the board of directors. During this review, the board of directors considered relationships and transactions between each director or any member of his or her immediate family and Consolidated and its subsidiaries and affiliates, including those reported in this proxy statement under “Certain Relationships and Related Transactions.” The board of directors also examined relationships and transactions between directors or their affiliates and members of our senior management. The purpose of this review was to determine whether any such transactions or relationships compromised a director’s independence.

The board also considered the relationship between the Company and H&R Block, a company that purchases telecommunications services from the Company in the ordinary course of business, because Mr. Gerke is an officer of H&R Block. The Company received $172,494$92,139 in payments from H&R Block in 20192021 from 7341 separate H&R Block locations. Similarly, the board also considered the relationship between the Company and Hefner Stark & Marois, LLP, a law firm that also purchases telecommunications services from the Company in the ordinary course of business, because Mr. Taron is a partner with Hefner Stark, & Marois. The Company received $24,781 in payments from Hefner Stark & Marois, LLP in 2019. The board concluded that since certain of the services provided by the Company to H&R Block and Hefner Stark & Marois, LLP are offered pursuant to state and federal tariffs, and that purchases of all services were made on customary business terms, these relationships werethis relationship was not material for purposes of The NASDAQ Stock Market LLC’s (“NASDAQ”) listing standards and would not influence Mr. Gerke’s nor Mr. Taron’s actions or decisions as directors of the Company.